New Portfolio Position — PESI

Business on the cusp of major profitability inflection, offering multi-bagger upside

In this post, I am excited to share a new portfolio idea: Perma-Fix Environmental Services (PESI). I came across this idea in this VIC write-up published in July. I believe PESI offers an intriguing bet on company’s major revenue and profitability inflection in the coming years, driven by several large government contracts. If the anticipated growth materializes, the stock could easily be a multi-bagger from current levels. However, I’d note that the setup is quite complex, with multiple moving parts involved. The situation has been comprehensively covered in the VIC write-up and the comments section, so I highly recommend reading them to get a full grasp of the dynamics at play.

Now, let's dive into the investment idea.

Perma-Fix Environmental Services (PESI)

Elevator pitch: A nuclear waste treatment services provider on the cusp of an operational performance inflection, offering multi-bagger upside.

Current price: $9.90

Target price: $30+

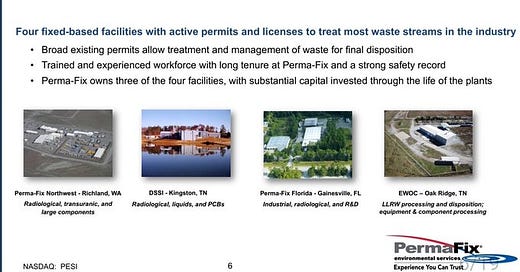

Perma-Fix Environmental Services is a $156m market cap company that provides nuclear and hazardous waste treatment and related environmental services. The company operates two segments: Treatment (c. 50% of revenues, primarily nuclear waste treatment) and Services (c. 50%, including site decontamination and decommissioning, among other services). The Treatment segment comprises PESI’s four active nuclear waste treatment facilities in the U.S. (see the slide below). These facilities are scarce and difficult to replicate due to the lengthy, roughly 10-year process required to secure permits and complete the construction of a new plant. PESI generates the majority of its revenues (79% in 2023) from government contracts, primarily in the U.S.

The investment thesis centers around the opportunity for PESI to treat substantial volumes of radioactive waste from the decommissioned Hanford site under several large government contracts that have already been announced or are highly likely. Given the contracted/expected volumes of 1) nuclear waste and 2) nuclear waste by-products (secondary waste) that will be treated by PESI, company’s annual revenues are likely to more than triple starting in 2026. Considering the high incremental margins, the company is currently trading at less than 2x the estimated EBITDA from the Hanford-related contracts alone. This is way too low of a multiple for a highly visible, recurring, long-term (10+ years) revenue stream. As the market becomes increasingly aware of the large Hanford opportunity, I would expect the stock to re-rate to a much more reasonable, say 8x-10x EBITDA, multiple.

That’s a very brief, bird’s-eye overview of the situation. Let’s now unpack the setup in greater detail.

The best place to start is with a quick background on the Hanford site. Hanford is a decommissioned nuclear production complex located in Washington, where the majority of U.S. plutonium was produced during the Cold War. Site’s clean-up process began back in 1989, marked by the tri-party agreement signed between the Department of Energy, the Environmental Protection Agency, and the Washington State Department of Ecology. Significant progress in the clean-up process has been made so far, including facility demolition, soil remediation, and groundwater treatment. This has left the treatment and disposition of tank waste as one of the final steps in the clean-up process. Currently, there are 54m gallons of radioactive waste sitting in tanks buried underground at the Hanford site. The majority (95% or c. 50m gallons) of the tank waste volume is comprised of so-called low-activity waste (LAW) compared to the more radioactive high-level waste (HLW). I’m pointing this out because LAW is the main focus of the investment pitch.

As part of the tri-party agreement to treat the low-activity waste, the DOE finally completed construction of the direct feed low-activity waste (or DFLAW) plant last year. The plant will vitrify (put simply, melt nuclear waste into glass) 1m gallons of LAW per year, with total treatment volumes over the plant’s lifetime estimated at around half of the total LAW volume, or c. 25m gallons. The plant is expected to become fully operational next year, with the tri-party agreement stating that the DOE must start treating the LAW by August 2025.

Without going into too much detail, what’s important here is that the vitrification process produces an additional around 2 additional gallons of by-product/effluent (i.e., secondary waste) for each gallon of LAW treated. This occurs as the melting process generates toxic gases that are later condensed into a liquid, which subsequently needs to be disposed of. The DFLAW plant is expected to produce 1.8m gallons of this offgas effluent annually.

While the government plant could potentially treat this offgas effluent using the vitrification process, this would create an additional c. 2 gallons of byproduct. So, there is a catch-22 of sorts: the more waste/effluent is vitrified, the more effluent gets created. This puts DFLAW/DOE in a position where they need to outsource the treatment of offgas effluent to a third party.

This is where Perma-Fix comes in. In early 2023, the DOE announced a record of decision to ship c. 1.8m gallons of offgas effluent annually to PESI’s nearby Richland facility. PESI will subsequently grout the effluent (i.e., mix the effluent with a stabilizing material and solidify/seal it). The DOE’s record of decision specifies that the offgas effluent will be shipped for 10 years, but there is a very high likelihood that the contract will be extended until at least 2050 — I cover this in the discussion of risks below.

What revenues and profitability could this offgas treatment bring in for PESI? Company’s management has stated that it expects to receive $40-$45 per gallon of treated effluent. This pricing range estimate was confirmed in this DOE report from January 2023, with the report also citing a $38/gallon estimate for EnergySolutions’ nuclear waste disposal facility in Clive, Utah (see page 192). Assuming a price per gallon of $40 implies potential revenues of $72m per year, in line with what PESI’s core business generated on a TTM basis. The company expects incremental treatment gross margins of 70-75%, with additional labor and SG&A costs of c. $20m-$25m (see the slide and quote from the Q3 2023 conference call below). This would imply $25m-$30m in potential incremental EBITDA compared to PESI’s current EV of $171m and TTM EBITDA of -$7m. So, it could be argued that at the current prices, the market is valuing the Hanford offgas treatment-related revenue stream at around 7x EBITDA.

We'd be looking -- we believe our incremental range, which we openly advertise at about 25% variable costs or 75% margin is consistent for this waste stream. The big wildcard is the capital and fixed expenses that would go into growing the company to support this kind of number. And we've talked about 100 FTEs. We've talked about capital in the $5 million to $10 million range. We've talked about other expenses, which we typically consider fixed in nature, utilities insurance, maintenance, et cetera, that's probably another $10 million to $15 million of cost.

Now, you might be thinking, “Yes, the Hanford effluent treatment opportunity presents a recurring, long-term revenue stream, but 7x EBITDA does not seem screamingly cheap, especially for a company with a loss-making core business and a spotty track record of historical profitability and cash flow generation.”

This brings me to the other core element of the investment thesis: the opportunity for PESI to grout LAW (i.e., not effluent/byproduct) from the DFLAW plant. Recall that the total low-level nuclear waste at the Hanford site stands at 50m gallons, while the DFLAW plant is expected to treat 25m gallons during its lifetime. So, what does the DFLAW plan to do with the remaining waste? Well, the government has come up with a plan to treat the remaining portion of nuclear waste (referred to as “supplemental LAW”) with offsite/onsite grouting (see this document, refer to Scenario 2). As part of this plan, the DOE initially intends to retrieve and then ship the majority of the remaining supplemental LAW from Hanford’s West Area to commercial nuclear waste treatment facilities for grouting during 2026-2040. These facilities will include, as you might have already guessed, PESI’s Richland facility.

The exact volumes to be shipped for grouting at the Richland facility have not yet been confirmed. However, judging by PESI’s management comments (see the quotes below) and the estimated total West Area waste volumes (see here, p. 164), the total waste available for grouting will be around 3.5m gallons annually. PESI expects to treat the majority of the waste, or over 1.5-2m gallons annually. Tank waste retrieval in Hanford's West Area is expected to commence in January 2026, suggesting that grouting at PESI’s facility will begin shortly thereafter. I’d quickly note here that the volumes to be treated with grouting are substantially higher than the 25m gallons of LAW. This is due to the fact that, aside from the vitrification process, effluent is also generated during the retrieval of low-activity waste from high-level waste, with around 2 gallons of effluent produced per gallon of tank waste.

From the August 2024 conference call:

And what they committed in there to do is 22 tanks over 15 years, basically. They are out for procurement right now with the systems to extract the waste from those tanks. Our understanding is the design for those systems is about 3.5 million gallons a year or so is what they're anticipating, and they're basically pumping that waste out of the tanks into totes for commercial off-site treatment. And those extraction units are to be delivered, installed, and operational in December 2025, with a potential start date for January 2026.

[…]

So, we expect to get a significant portion of that waste. I wouldn't suppose that we'd get all of it because DOE will want alternative backups along the line, but we do expect that we can get at least half. That's our estimate, the speculation, and that would be 1.5 million gallons a year, which would be a great revenue stream for us.

From the May 2024 conference call:

Also defined in the new Settlement Agreement, DOE is committed to complete waste retrieval from 22 tanks within the West Tank Farm for grouting off-site and disposal off-site by 2040. It's difficult to define the exact quantity of waste to be removed from this inventory during that period, but unofficial estimates include expectations for up to approximately 3 million gallons of waste to be processed annually to meet these goals for 2040. The agreement is unclear about when these operations would commence. However, the recent Hanford Systems 10 document defines retrievable operations beginning in the January 2026 time frame.

It is not hard to see how this is a very significant revenue opportunity for PESI. Company’s management has stated that it expects to receive $100 per gallon for the treatment of supplemental LAW. This pricing estimate seems reasonable, if not too conservative, given that the cost of grouting per gallon at another decommissioned nuclear site, Savannah River, was previously estimated at $153 in 2021 (here) and $200 last year (here). Using a $100/gallon price and the low-end volume estimate of 1.5m gallons, the potential annual revenues would be $130m. Assuming the same incremental margins and labor/SG&A costs as for the offgas effluent treatment opportunity, the EBITDA contribution would stand at $80m-$85m. So, clearly, the supplemental LAW contract will be highly transformative for the company.

Now, I’d like to note here that, unlike with the offgas effluent treatment, the contract to grout supplemental LAW has not yet been officially announced. As it stands, while the supplemental LAW grouting at PESI’s facilities has been confirmed with the amended tri-party agreement (announced in April 2024), the public comment period for the amendments is currently ongoing and is scheduled to end in September 2024.

Having said that, I’d expect a record of decision or another announcement to follow shortly after the end of the comment period. Moreover, I believe there is a strong likelihood that the actual volumes will significantly exceed management’s guidance of 1.5-2m gallons, potentially ending up closer to 3m gallons. Why am I so confident that the contract to grout LAW at PESI’s facility will be formally announced, and possibly at higher volumes than management expects? There are several reasons:

PESI’s Richland facility is by far the closest nuclear waste treatment plant with grouting capabilities to Hanford. The facility is located just one mile from the site, while the only two other nuclear waste treatment plants permitted to treat Hanford’s LAW are in Andrews, Texas (more than 1,500 miles away) and Clive, Utah (600 miles away). Given the environmental risks associated with transporting nuclear waste over long distances, it’s highly unlikely that regulators will choose the Texas or Utah facilities. As an illustration of the opposition to shipping waste to these more distant facilities, see these public comments submitted to the Washington State Department of Ecology, which highlight the environmental risks of long-distance nuclear waste transportation. As for the other nuclear waste treatment plants, PESI’s management has noted that obtaining state permits for nuclear waste grouting takes over 10 years.

PESI successfully completed a proof-of-concept phase for the supplemental LAW treatment back in 2017, when it treated and disposed of 3 gallons of tank waste from the Hanford site.

As part of the LAW treatment plan in Scenario 2 (which has already been adopted by the tri-party agreement), the DOE has explicitly assumed that supplemental LAW grouting will be completed at PESI’s Richland facility for the purpose of estimating project costs and timelines (see, for example, page 164). This seems to be a strong indication that PESI will ultimately receive the contract to treat at least the majority of West Area volumes.

So, to sum up, we know that 1) there is a lack of feasible alternatives for treating supplemental LAW, 2) PESI has proven grouting capabilities, and 3) the DOE has already publicly indicated that PESI is the most feasible and likely option for commercial grouting. These points, coupled with DFLAW’s limited capacity to treat supplemental LAW, suggest that an eventual contract win for PESI, potentially at higher volumes than management expects, is highly likely. Considering the expected earnings inflection, I anticipate that an official contract or decision announcement in the coming quarters will catalyze a significant stock re-rating.

By now, I hope I've established why the Hanford site waste treatment presents such a lucrative opportunity for PESI. Given the off-gas effluent and supplemental LAW grouting opportunities, the company is likely on a path toward a significant topline and EBITDA inflection in the coming years. As shown in the table below, we could be looking at a company with c. $300m in revenues and $100m in EBITDA several years down the road—quite impressive considering the current EV of $171m. Incremental FCF generation from the Hanford contracts is likely to be substantial, as management has stated that the additional capital expenditures required for the Richland facility to treat the expected effluent and supplemental LAW volumes are minimal, at $5m-$10m.

Now, let’s address several risks to the investment thesis. I think there are decent counterarguments against each.

DFLAW delays. One risk is that the Hanford DFLAW plant may not start the LAW vitrification process on schedule, delaying the shipment of offgas effluent to PESI’s Richland facility. However, with the construction of the DFLAW plant now complete and recent melter tests going successfully, this risk seems minimal. I’d also note that as part of the tri-party agreement, the DOE is under a hard deadline to start LAW treatment by August 2025. As for the supplemental LAW grouting opportunity, the DOE is similarly obligated to fully grout West Area waste by 2040, so I’d expect the retrieval process to begin without delays.

Effluent treatment contract not getting extended. The DOE’s record of decision states that effluent will be shipped to PESI’s facility for 10 years “until such time as an enhanced onsite treatment capability is available for DFLAW operations.” Is there a risk that the DOE might shift to onsite effluent treatment after 10 years? Yes, but I believe it is minimal. For background, the DFLAW plant has the capability to treat effluent itself using either 1) vitrification and/or 2) treatment in its effluent treatment facility. Currently, neither of these options is viable due to limited capacity, and vitrification also has a significantly higher cost than grouting. While the DOE plans to significantly expand its effluent treatment capacity, this expansion is only expected to come online around 2050 (see here, p. 139). This suggests that the DOE will need to rely on PESI for grouting effluent for at least 25 years, much longer than the stated contract duration. I would also refer you to this recent statement from PESI’s management:

You're correct that the DFLAW facility has a design life through 2060, where they plan to process about 1 million gallons a year during that period. The DOE has stated publicly that they have no other viable options currently available to meet the treatment obligations for the DFLAW effluent facility and that they are not currently pursuing any construction line items for new buildings or facilities to support that.

So, we're pretty comfortable that right now, we're the deferred alternative for a minimum of 10 years, and we would expect to go longer than that as we have the facilities available right now with the flexibility and capacity to support it through 2060.

Political risk. Given the potential for a Trump presidency, there is a risk of the new administration delaying or even terminating the Hanford tank waste cleanup process. However, given the massive investments already made (e.g., vitrification plant’s cost was previously estimated at $17bn) and the fact that the DFLAW plant is expected to become operational within the next year, I believe this risk is minimal.

Do you know how around how much PESI will charge for grouting? During PESI's Q4 2022 conference call, Mark Duff mentioned a price of $100 per gallon for the TBI program, and he indicated that a similar rate would apply to treating supplemental LAW. However, at the Gabelli Funds 10th Annual Waste & Sustainability Symposium, Mark suggested that PESI might charge between $10 and $30 per gallon for grouting. I already emailed their IR, but have not received a response yet.

Thanks for the writeup! I am confused why the the revenue per gallon for grouting the offgas effluent is $40-45 but the supplemental LAW would be $100/gallon. Are these streams being treated the same way? What's the reason for the difference?